Malaysia Import Car Tax Fees

Import duties are worth about RM 28 billion a year but since. Maintenance - 800RM year.

Own A Recon Audi Here S How You Can Get A Warranty From Audi Malaysia Wapcar

So make sure you check if the.

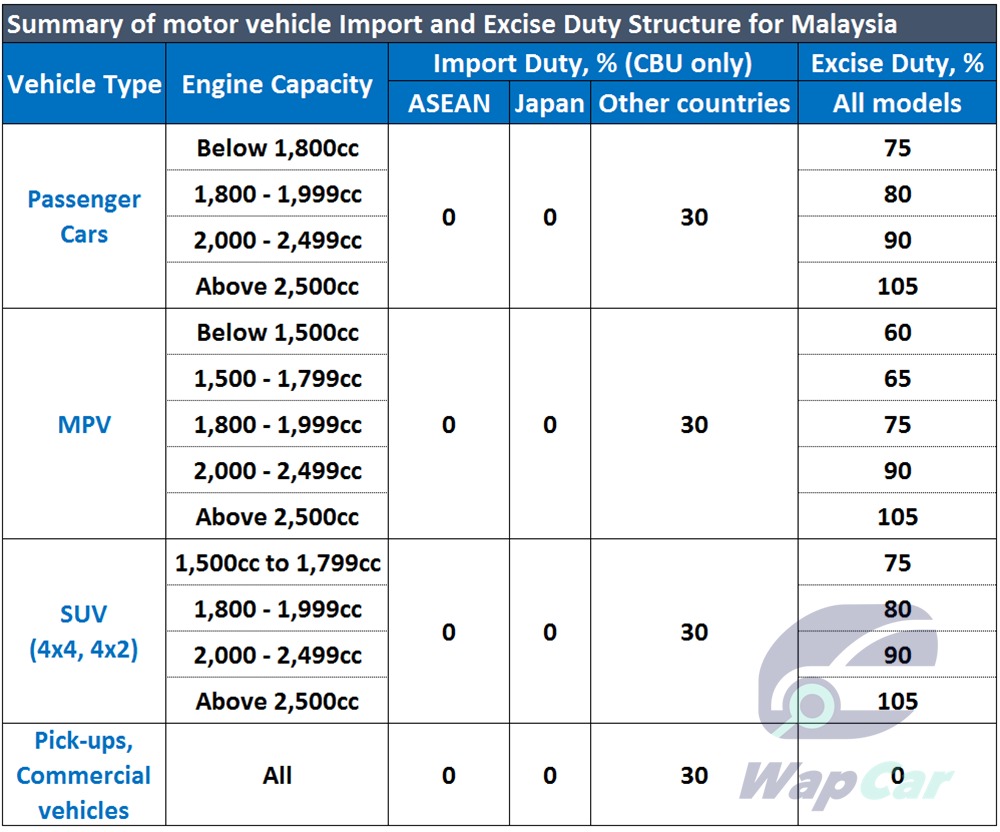

. All inquiry about the vehicle registration is in the link as follow. Excise duty is between 60 and 105 regardless of CKD or CBU calculated based on the car and its engine capacity while import duty can reach up to 30 depending on the vehicles country of. Before you calculate the fees the first thing you have to do is choose a car model and make.

The car is inspected by PUSKAPOM the Malaysian vehicle inspection agency. Want to save time. In Malaysia sales tax for vehicles has been set at 10 for both locally assembled and imported cars.

At present the excise duty is set at between 60 to 105 for both locally assembled and imported cars and it is calculated based on the car model and engine capacity. It is worth noting that most car exporters and auction houses in Japan feature the FOB. And the Freight insurance cost.

Level 15 Block 10 Jalan Duta 50622 Kuala Lumpur. I Taxable goods manufactured in Malaysia by any registered manufacturer at the time the goods are sold disposed of other than by sales or used other than as a material in the manufacture of goods. The car cannot be sold or transferred.

Road Tax - 90RM year. The value of your order. Aside from the sales tax vehicles sold are also charged with other taxes namely excise duty and import duty.

Our Malaysia Customs Broker can assist you to calculate import and export Duty charges. Its fast and free to try and covers over 100 destinations worldwide. Please feel free to visit our site to know the prices of the cars you wish to import.

Ii Imported goods when the goods are declared and duty tax paid at the time of customs. Goodada can help you with your Malaysia Import and Export Duty Clearance. JPY 100 RM 33000 Exchange rates are updated every Sunday following CIMB rates Full Breakdown.

Why Sellers use Our. Once the car arrives in Malaysia the owner must collect it in person from the port of entry. Meanwhile the import duty can go up to 30 which varies based on the vehicles.

Duties Taxes Calculator to Malaysia. Calculate import duty and taxes in the web-based calculator. Where can I find a car and how.

Estimate your tax and duties when shipping from Malaysia to Malaysia based on your shipment weight value and product type. To calculate the import or export tariff all we need is. Parking.

If an assessee has not filed his or her service tax return then a late payment fee of Rs 500 will be charged for the initial 15 days of delay. Insurance - 1100RM year. Road Tax for Public Transport JPJ.

Sales tax administered in Malaysia is a single stage tax imposed on. How to import a used vehicle into Malaysia. You can see a breakdown of estimated costs of owning a car in Malaysia below.

This sales tax exemption on purchases of new vehicles was previously granted from 15th June 2020 until 31st December 2020 and was further extended by another 6 months to 30 June 2021 by the MoF as an incentive to spur car sales at a time when. If you were to import your vehicle into Malaysia youd be required to submit an. The imposition of very high import duties make owning a non Malaysian made car somewhat expensive.

Tips on how to Sell Internationally. If youre looking to purchase a. Users can bid for a specific vehicle registration number online.

Import duties run to as high as 300. Vehicle must be exported when employment in the country ends. We dont know the contribution of new car sales to SST collection but since a RM 50000 car customs value excise duty import duty included pays RM 5000 in sales tax it is safe to estimate that the 600000 cars sold annually contribute at least RM 5 billion in sales tax.

Vehicle importation only for personal use only. 03 6203 4485 03 6203 3022. What is Malaysia import tax.

Motor Vehicle License LKM rates calculation guidelines for vehicles in Peninsular Malaysia Sabah and Sarawak is in this link. If an assessee has not filed his or her service tax return then a late payment fee of Rs 1000 will be charged for delays ranging from 15 to 30 days. Choose the Vehicle Model and Make.

Duties Taxes Calculator to. Direct import concept solution D concept car import tax malaysia car import agent Malaysia car import rules and regulations car import duty import car from australia to Malaysia malaysia car import tax calculator how to import a car shipping car to malaysia recond car AP car car from japan car from uk car from australia vehicle import duty importing a vehicle can i import a car.

Cars With The Lowest Service Costs In Malaysia Car Owners Guides Carlist My

Image 4 Details About Will Indonesian Buyers Accept The Proton X70 Wapcar News Photos

Topgear Ev Talk Why The New Tesla Model S S Road Tax Would Cost Rm17k In Malaysia

309a9253 Edit Honda Civic Honda Civic Si Sema 2019

Own A Recon Audi Here S How You Can Get A Warranty From Audi Malaysia Wapcar

Comments

Post a Comment